By

Sampson I. Onwuka

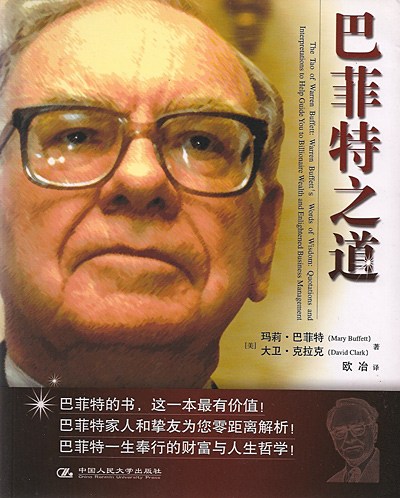

zeistful picture of Warren Buffet.

There market efficiency arguments to be made about price history by many wonderful experts. The central key word for price history is management and result which Warren Buffet more than recent expert is firmly associated with it. We may suggest that he has also influenced management style in the last half a century in the United States and elsewhere. His style is world renown but is not exactly the best practice or do we state for sure that such styles are immune to failures and weakness or shocks from poor management procedure. But this is the point that price history matters, records of company performance matters, reputation in business matters but we can also state clearly that none of that is a deciding factor in real business exercise. We can suggest that management style may help individuals adjust to business interest and choice and this is closer to fundamental use of judgement than a general rule for deciding in any market.

It is important to reason for Dummy Variable is to navigate the market function in such a way that we deliver the psychology of wealth and human consumption from unrealized sentimental. It is not a motivation in the case to call this uniform theories of disequilibrium or a pressure to respond to the dynamics of a bear market shifting to a General Equilibrium or macro over micro. It will not also defend the idea that opposite which is momentum has bullish tendencies, or interacts between idea of changes in the market in real time or a flow, without a modality as pathology is the opposite of the fundamental or optimal requiring graphs and variables.

Each stage has its redeeming definitions – price and advantage and has losses and disadvantages, but disequilibrium is ultimately a personal pursuit of the remote sense of happiness and satisfaction and the market like most trading places determines the movement and not the companies. Behavioral economics gives a false sense of price which has no history and for that reasons fundamental market movers second guess market momentum. If I should challenge some of the assumptions in Warren Buffets intellectual currency that price does have history, I may begin by pointing to the levels of market expectations and perhaps the NIARU – even at undetermined appreciation level.

In point to the same fate and argument made by Benjamin Graham and in recent times, Warren Buffet, the systematic induction of price movement as a function of human decision, exist only on certain level. The level is not very obvious as far employment rates are concerned, or as far as quantity is concerned, the level is operational dynamic of entry consumptive data indexing and somewhere in the middle management where quantity and duration pamper some of the risk factor and momentum. In some sense, price becomes subordinate to history and to fundamental coercion of quarterly and periodic earnings when there are obvious dissolution of white noise or signs of indigent reaction of the total carrier to external or internal shocks to the system.

At the level that Buffets refers to, our expectations of total economic package and returns on investment based on daily movement and revert flow to stochastic (stock), size and quantity becomes important. A sizable of the proportion that Buffet operates with and perhaps Graham, makes price and cyclical economic returns very important, given the tendency to insulate momentum by stretching the expectation to less 5% or less cumulative profit.

The financial polar tug and gravitas to earning rates at that levels is usually poor informative procedure given the size considered. We can add that the study of the risk factor involved is to closer to balancing of equilibrium or uniform convergence to equilibrium – a bad thesis for market impetus leading to general equilibrium or what constitute oversight under micro-management. Size does matter in deciding the history of numbers, does not mean it is correct, does mean that size of investment in so far a linear market is concerned or one industry as the case of tier 1 and perhaps tier 2 without the distinct issue or role of money supply-, size can move any market at any time to a specific direction forcing momentum even without the convexity bias of less than zero or the skewer (skewness) distributed with less on perhaps diffusion rate over duration.

Size can also diminish the ability to move mutual funds from real estate or revert to gold on earliest signs of fluctuation – which is behavioral – to some extent irrational as opposed market decay which are changes in elastic constant over a 9 year cyclical economic long term.

There are stages of these development and generational pathology and it applies not to the companies in a sector – age of the sector but also the political age of the economic community whose instability is usually a false justification for actions primitive to accounting and corruption which is the bane of most societies. Showing the duration of some companies operation in any industries may be important information in determining what may or may not be a controlling factor in brokering a study in specific industrial sector of any demand and supply. PIMCO removing their investment vehicle from U.S bond market may be tactically induced by financial institutions, no less purported to Lehman and Bear Stearn with view of stimulating stock market or cast aspersion on IOU as efficient market position reverting to gold. Federal Government usually throw money out there to the banks during emergent control problems of momentum to forestall skidding and kurtosis and enable size and economics of quantity as item to helm fluctuation reducing the momentum and panic in the global market.

Peter Phan (2015)---writing for Forbes on Warrent Buffet favorite book ‘The Outsider’ a William K Thorndike (2012), describes the importance of records in the life of a company and the practical exercise of Berkshire Hathaway. That "Warren Buffett is better known for investing in companies like The Coca-Cola KO -1.04% Company and GEICO, which are heavily covered by the markets and the media. Unbeknownst to many is Buffett’s deep engagement in entrepreneurial activities that provide seed capital. In today’s businesses, a CEO plays a vital role within an organization. From a valuation perspective, their strong track record will drive market confidence and make the company more attractive to investors." As such tract record to price history is commercial interest for mounting investor confidence.

If investor confidence is reach by numbers and consistent delivery rate, the numbers add momentum is sufficient to ensure that rating from primary and secondary sources are relevant. 1% is to important to ignore but junk bonds for practical real time investment is discount for larger return, to bond rate perhaps risk averse. Preferred (Prebend) attraction for exceptional stocks (that is companies in nose-dive) allows a different argument by Warren Buffet to prosper for reasons of debentures or above the market price (usually below) with new and defunct companies as target practice.

We can still argue that ability of any company to adjust to momentum or return to normal distribution following shocks to the system, excise the strength of the company or performance of the management. It is also a exercise of a company’s competitive advantage. But profit is by default on the argument that company’s yield is based on the shortfalls in other companies especially big companies that were mismanagement. Efficient market hypothesis.....

In a sense, understanding a tendency to abbreviate or gauge what happens to a specific interest item or study – gives us a hint of one’s pathology – does not mean that an emphasis on history is prove that an expert is looking at what happens to fundamental changes in the market and why it does. To obviate that the intellectual ancestors of market makers were chartist or bond’s men perhaps with graphs to burn in, may influence attitude to market apps - it may seem to show the age of the brain involved (experience), may explain the gap approaching the reasons why some experts emphasis summation or reduction and why they defends the assumptions that a process or strategy needs to be defended to a point of apathy – show signs of sentiments or overall strategy and therefore in appropriate in accessing risk value.

We can consider the use of dummy variables as a means of overcoming sentiments which show up every now and then. The question about market price and history, explains the limits of market exercise that compares the past to the present, as way to broker the future in spite of changes in world market. A 2008 symposium is a false entropy although the ‘taste of the pudding (purnice) is in the eating’, Warren Buffet ability to offset some of his companies and re-alternate his preferred shares in certain major Banks – Wachovia to mention – is an exceptional candidature and probably not the norm. The veracity of price over history – vice versa – require larger platform but it is important to note that even fundamental shocks and sentiments in the markets which is enforced by records may reflect more troubles with a company and the market blinded from easy operators. Although the Lagrange officialdom on transmitting the limits of linearity of economic models to disequilibrium explains General equilibrium.

That Jevon to the left sided materialist such as Alfred Whitehead, some of the examples in the history of mathematics and reduction of intelligence to basic and adulterated formulas, explains the age of the cultural history, the size of the industries and the persons on interest who we call the intellectual ancestors. A proof to show course is a legal as well mathematical indicia of prosecution that a Roase as open to Coarse would divide to alter that in law in art, the rule of logics is reduced to numbers – each an items of process explaining perhaps a period.

We look at the decision of most economists to use dummy variables to widen the scope of tables as a form of pathology that entails as much problems as the first men and perhaps women used pebbles to organize house management. It does not appeal that a poverty in Gaussian mathematically models diminishes a Movier (?) over Paschal on the limits of probability, or does it shy from the weak arguments on recent market hypothesis in names of Fama and in deeds of Black.

No comments:

Post a Comment